If you’re paying off debts (like student loans, credit card debt, or medical bills) this year, you should add a tracker designed specifically to help pay off debt. Your calendar isn’t meant to track small, day-to-day expenses like a cup of coffee, so you should also use a spreadsheet or tracker to stay mindful of how minor spending can add up. To maximize the power of your calendar and set yourself up for a successful year, you should add a few other tools to the mix: While a budget calendar is a powerful tool, it’s just one weapon in your financial arsenal. Plotting key dates and recording your cash flows will help you anticipate and plan for financial events and emergencies, preventing you from being caught off-guard and having to deplete savings or go into debt.

#BUDGET CALENDAR 2016 DOWNLOAD#

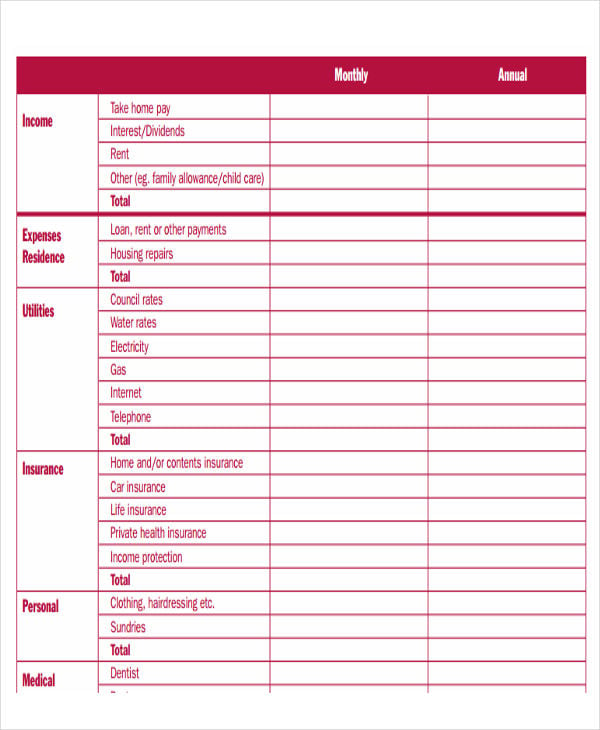

We’ve created a printable budget calendar designed for organizing your money in 2023 - download and print it to get started! How a Budget Calendar Can Help You Achieve Financial GoalsĪ budget calendar can help you with whatever you hope to accomplish financially, whether it’s paying off existing debts or building up savings to invest in your future. You can choose to add a budget calendar to your existing paper or digital calendar, or you can create a brand-new calendar that’s just for tracking your finances. And there’s no better way to do so than by creating a budget calendar to track your income, expenses, and financial goals throughout the year. You may also want to look ahead on your calendar and add items like back-to-school purchases or holiday gifts or summer vacation.The new year is the perfect time to recommit to getting your finances organized. You may want to mark days or weeks that you expect to get your oil changed, buy new tires, take your dog to the vet or purchase a birthday gift for a relative, for example. If you don't put money away regularly, it's also a smart idea to earmark certain days to save money.

Moneydance has numerous features, from online banking and bill payment to investment tracking. At the time of this writing, it was on sale and marked down to $24.99.

Price: $29.95 flat rate (no subscription). Money Calendar comes with auto-generated charts to help you track your spending from month to month, which, as its website states, should help you analyze your financial past and then plan your future revenue and expenses. When a bill needs to be paid, you'll get an email reminder that it's due.

It also helps you track how much you're spending every day, not just in fixed bills, such as rent payments or utility bills, but also for things like dog grooming services. CalendarBudget offers an easy way to categorize and divvy up your budget.

0 kommentar(er)

0 kommentar(er)